*Update 2020 – my views on this topic have changed somewhat. At the time of this update, I believe Xero offers a better feature set and user experience than the equivalent Quickbooks product.*

So, as I write this, Computercentric are now two months into our transition to QuickBooks Online, Intuit’s accounts software for small & medium sized business, and I thought it was about time we shared our experiences, to help you to make your mind up, and also, selfishly, in the hope that QuickBooks developers spot this and pull their collective fingers out of their collective arses to make a superb piece of software even better.

If you’re running a business, and you don’t have an accountant who manages all your bookkeeping requirements, you need some accounts software to do it properly. Proper accounts software gives you the visibility you need to make the correct financial and business decisions. Without it, you’re shooting in the dark. I wrote an article a few years ago, on the alternatives to Sage for small businesses, it’s still one of the most popular pages on our site, proving that this is one area people take time to study and evaluate their options before they make a decision. In the UK, Sage is still the dominant provider of accounts software to small / medium sized businesses, but it’s crown is really slipping. Estimates vary, but one thing is for sure, Sage’s market shared in this sector is on the decline, and new customers looking for an accounts system are more likely to start up with one of the newer (and arguably better, cheaper, more flexible…) alternatives.

The main reason people still use Sage today is because they always have, and they think that moving to the competition would be a massive undertaking. Well it can be difficult, but if you align your move to a new system with your financial year end, then it’s not much of a headache, and the benefits should really be considered. We ditched Sage 6 years ago and haven’t looked back. We’ve been using QuickBooks Desktop since then, but at the start of the year we moved to QuickBooks Online, Intuit’s cloud-based offering, also known as SAAS (software as a service) – All this means is that you don’t install the software on your computers, you access everything through a web browser or mobile device. We considered our options carefully, we even re-visited Sage, and we looked at other fully installed software, and a number of cloud options too. For us, QuickBooks Online came out on top. Sage 50 is pretty much the same as when I left it six years ago so we skipped over that option quickly. The top two options for us were Xero and QuickBooks Online. Xero looks nice, it’s quite flexible, well priced, but just didn’t do some of the key things we wanted, so we settled on QuickBooks Online. In fact QuickBooks has been offering an online accounts solution since 2004, so they should have it about perfect by now, right?

Now, I would count Computercentric as quite an advanced user of the system. We really push our accounts software to do what we need it to, taking full advantage of features like mobile device access and the integration API for transferring information from our other systems. After a couple of months of heavy use, I can report back on what’s good, and what’s bad about QuickBooks Online.

User Experience

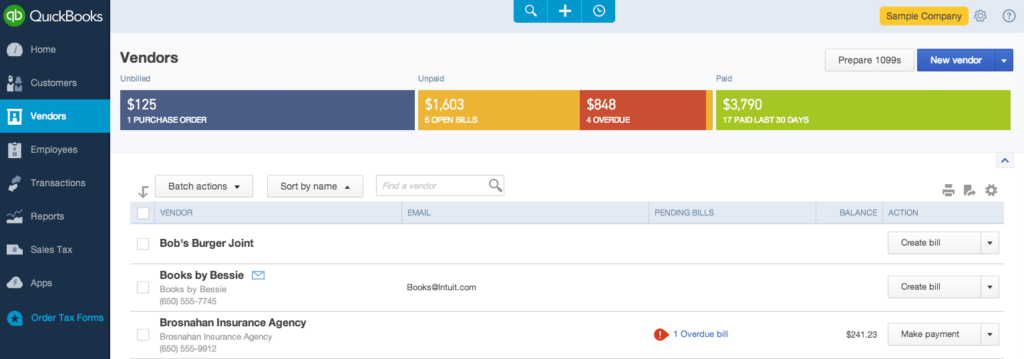

Well, it’s nothing like QuickBooks desktop. If you were expecting the cloud version of QuickBooks to be the same as the desktop version, it’s not. In fact it’s completely different. The navigation of the system is designed around being able to get to all important areas with the minimum number of mouse clicks. In a “normal” installed Windows or Mac application, you have the ability for windows to open up, and to place them where you want them. In a web browser, whilst this is possible, it makes for a clunky user experience, so I am glad to see that Intuit have take the approach of making everything appear in one window, with a nice clean navigation bar down the side, and a setting menu up top, and a one-click toolbar that lets you go directly to creating a new sales invoice, bill, purchase order or payment receipt. It takes some getting used to, but we like it.

Integration

Amongst the many things we do at Computercentric, one thing we’ve got lots of experience doing is integrating our client’s business management systems into their accounts software. We’ve done it many times with Sage 50, and Quickbooks Desktop. To do this requires use of, and understanding of the “API”. The API (Application Program Interface) is the toolkit made available to software developers like us use in order to get data into or out of your accounts software. With regard to QuickBooks, it seems that progress of their Desktop API is coming to a halt, and all new features are focussed on the Online version of their product, this was one of the factors that affected our choice in moving from QuickBooks Desktop to QuickBooks Online. The Online API is fantastic, it’s very easy for our developers to deliver powerful integrations into other systems. For example, at Computercentric, like many businesses we have a single database of all our cuctomers and suppliers, we use the API to synchronise this database with Quickbooks, so we never have to retype the contact details for a customer or a supplier. We also have Quickbooks Online integrated into our document management system, so every paper invoice that comes in from our suppiers is scanned and immediately uploaded to Quickbooks so we don’t need to maintain bulky paper files for our invoices. All these things are possible with Sage and QuickBooks Desktop, but it’s a lot easier to do them with QuickBooks Online.

A lot of our clients use mobile forms software like Prontoforms for collection of data “in the field”, like engineers’ job sheets, time sheets, visit reports etc… We can very easily take this information and automatically create invoices and send them out, which makes for a great time saving opportunity, and leverages the power of tools like Prontoforms, mobile devices and the QuickBooks Online API.

Customisation

If you’re an SME like us, the extent of your customisation of an accounts system will be fairly limited. You’ll need to get all your products and services set up, and of course tweak the chart of accounts to suit your own needs. It’s also important to be able to customise the standard forms that the system produces, such as quotes, invoices, sales orders, purchase orders and statements. In the respect, QuickBooks Desktop, and even Sage 50 have the edge. The customisation of the forms in QuickBooks Online is very limited. You can choose from a couple of standard layouts and colour schemes, and optionally include your logo, but that’s about it. If you need to customise your invoices or statements to include special messages about payment methods, early payment discounts etc… you can’t simply create a text box and put it where you want. In QuickBooks Online you are limited to the layout of the selected template. Whilst it may do the job for 90% of QuickBooks Online users, it’s a bit to restrictive for my liking.

Pricing

Most cloud-based software uses a subscription model for payment, unlike Sage 50 or QuickBooks Desktop where you purchase the software, install it, and pay again in 12 months if you want to upgrade, QuickBooks Online is delivered as a subscription basis, with a few different price bands depending on your needs. The most expensive option is £29 per month, for 5 users. This includes their Payroll software too. Compared to QuickBooks Desktop with Payroll, which we were using previously, over 12 months this is literally a third of the cost, which is good news. The downside is if you need to manage multiple businesses. In QuickBooks Desktop, this is no problem, have as many companies as you want. In QuickBooks Online, (and Sage) you have to pay extra for a separate licence or an additional company licence.

Support

Intuit do not (currently) provide email or live chat support, which is annoying. To get a decent response you have to call them up, and in the instances we have had to do this, our problems have been dealt with (excluding the issues covered below, where the stock response is we are aware of the problems….) In the past Intuit support has had a bad rap. Based on my experiences with Sage support, I would say Sage really have the edge here.

Getting your Accountant Involved

If, like us you employ the services of an external accountant to prepare your annual accounts, then in Sage and QuickBooks Desktop, your accountant will usually come to your office and take a copy of your software away to work on. In QuickBooks Online, you just invite your accountant from within the system, and send them a link. Immediately they have full access to your live system, and can start work without getting in the car. This is also beneficial if you have any queries that involve your accountant, as he / she can jump straight online, and see exactly what you see, and even fix it for you.

The Good

- Fast and responsive (as good as a web app can be!).

- Easy to use and navigate.

- Access your information from anywhere.

- No software to install.

- Brilliant if you need to integrate other systems.

- Full integration into most online banking systems for rapid reconciling of your accounts.

The Bad

- Invoices, statements etc.. cannot be customised as much as they can in other systems.

- It’s clunky if you need to download a PDF copy of an invoice or purchase order, you have to print to a virtual PDF printer rather than just click to download.

- You can’t raise a purchase order from an estimate like you can in QuickBooks Desktop. This is really annoying if, like us you detail the items you are selling to a client on an invoice or an estimate and have to buy specific products in to do the job. In QuickBooks Desktop you could click and produce a purchase order for all the items you needed to buy in from your supplier. In QuickBooks Online, this feature is gone.

- You can’t have a draft, or non-posting invoice like you could in QuickBooks Desktop. This is really useful if you raise invoices for stage payments or work that is delivered in chunks, or if you have staff that raise invoices, and would like them to stay as Pending invoices until they are approved.

- You can’t track your sales / purchases against a Customer / Job. In QuickBooks Desktop you could create Jobs within customers, and track your costs and sales on that individual job, and report on job profitability. This is pretty much gone in QuickBooks Online. There is a fudge you can use using the Class feature, but it’s not the same.

The Ugly

As I write this (February 2015) there are two MAHOOSIVE problems with QuickBooks Online, which deserve some special and immediate attention. Both these problems could be sorted in a matter of hours by their developers, and it confounds me why they haven’t already.

- Big problem 1

If you produce more than a handful of invoices a month, it’s almost impossible to identify which ones have been sent or printed off. We raise several hundred invoices a month, some of them are emailed out, some are printed, and by different people at different times of the month. Currently we have to individually open invoices to try and figure out if they have been printed or emailed out. This has already lead to us sending some invoices twice, and worse, not sending them at all. Intuit developers please take note, all you need is something like a checkbox on each invoice to say if they invoice has been manually printed, and make this visible / filterable on the invoice list. Then we can immediately see all invoices ready to send and send them.

- Big problem 2

If you email your invoices out, as QuickBooks expects you to do, many of them won’t get to the recipient, and there is no way to tell which ones have failed to deliver. This is a real biggie. QuickBooks Online sends out your invoices from a generic noreply@intuit.com email address. This causes two problems. Firstly, most of your customers will not recognise the email, and will delete it without opening it. Secondly, we have found delivery rates for these emails to be very poor. We estimate as many as 40% of our clients were not receiving our invoices sent from QuickBooks Online. They were either disappearing into the ether, or being blocked by commercial anti-spam systems. To compound the problem, there is no indication in QuickBooks Online to tell you if emails have been delivered successfully. (Note – unless you choose to use the “online invoice” option and not send PDF files – in this case QuickBooks Online sends a link, rather than a PDF, and you can see what has been opened by the customer. We choose not to do this, as I don’t want customers to have to click through to an unfamiliar website and download their invoices, I would rather just send them as a PDF file) Despite calls to Intuit’s support line, we have not been able to find a way around this, and out only options has been to contact individual customers, determine if they are receiving our invoices, and if not, see if we can talk them through whitelisting @intuit.com on their spam systems. Not a trivial task. Again this is a dead simple fix for Intuit, why have they not implemented it? All they need to do is allow customers to send from their own domain name, and use their own mail servers. This is not a big job.

Summary

We really love this product, the pricing, and how flexible and powerful it can be, however the shortcomings are currently a big obstacle to us recommending it to people. Especially when you consider the two big problems that hold us back also affect other customers, and could be resolved very quickly and cheaply.